#4. Borrowing from the bank Loan: Poor credit Finance On the internet

Such as for instance, only inquire about the amount you want, try to get a cosigner, sign up for you to definitely unsecured loan at the same time, and pay your financial situation out-of

- Funds considering away from $500 to $ten,000

- Acceptance in mere times

- Fund designed for company otherwise commercial goal

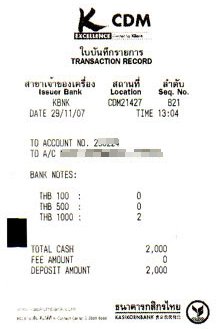

- Financing transmitted right to your bank account

Like, only inquire about extent you prefer, aim for a beneficial cosigner, make an application for you to definitely consumer loan simultaneously, and you will pay your debts regarding

- Maybe not a primary financial

In case the credit is terrible, when not below are a few Borrowing from the bank Financing, as they possibly can produce the bucks you would like timely.

It allow it to be only one active loan at one time whenever you are making use of their network. Therefore, when you yourself have already removed an unsecured loan with these people and are usually nevertheless using they back, do not expect you’ll score the second one to.

The firm has been in providers to own 20 years now and you can depending, and it also works in an exceedingly quick styles.

You start from the submission your data on the secure webpages. After that, might select a lender one to specializes in brief-number signature loans.

Second, you are going to study the conditions meticulously, and you will check out the website of your financial so you’re able to accomplish that. After you’ve look at the words very carefully, you could accept the private financing.

After that, you get to make use of your money as you would like. It get to your bank account in just 24 hours or quicker for the majority of banking companies; yet not, so it may vary with each financial institution.

The credit Loan solution is free, very feel free to check him or her away and see exactly what signature loans are available to you to you. Their site try better-built and simple to help you navigate. All of the concerns you could think regarding if you are applying is actually listed on their site, so see.

Additionally they features a section devoted for only people with crappy credit, and therefore are most inviting. Might even come across a video clip which explains less than perfect credit from inside the more detail and provides advice about how exactly to raise they.

Nevertheless they offer suggestions about what can be done adjust your odds of financing approval. And you will, naturally, have got all supporting records able, such as for instance shell out stubs otherwise tax returns.

Including, merely inquire about the total amount need, strive for a cosigner, submit an application for you to definitely personal bank loan at a time, and you will pay your financial situation of

- $250 in order to $5,one hundred thousand financing considering

- Dollars actually added to your bank account

- While the 1998, countless happier customers provides enjoyed this provider

- Bad credit recognized

#5. Surge Credit card: Greatest Charge card To have Less than perfect credit & Unsecured loans

Can you focus a little vinyl on your wallet, you had been refused everywhere? New Surge Charge card might be your solution. That it handy cards also offers some of the advantages of old-fashioned handmade cards, nevertheless restrict is lower, and that means you doesn’t get into an enormous debt gap.

Some of the pros are $0 into the liability to possess fraud. Thus, if a person can make a keen unauthorized charges, you will not feel held responsible. Simultaneously, all of the credit sizes try acknowledged with this Mastercard, so incredibly bad borrowing from the bank people cannot be shy on the applying. 3rd, you’re secured at least $300 when the recognized, that’s ideal for subprime borrowers/applicants.

That it card is for people that must enhance their credit score when it is in control which have a cards otherwise whoever has no borrowing from the bank and want to expose some. It will not give perks for example points or trip kilometers, however it is good if you like to construct borrowing and you can for higher using electricity.

not, you should be aware of your large yearly fee through your first 12 months out-of membership. The fresh new Annual percentage rate is also seemingly higher, making it important you pay off of the harmony timely along with complete every month. There’s a lot off battle regarding subprime ong borrowing cards, so some of you might wish to  below are a few most other cards products, such as the Indigo card.

below are a few most other cards products, such as the Indigo card.